A whopping 11.3 million veterans plan to buy homes within the next five years. That’s 58% of all veterans surveyed in a 2021 homebuyers report — and 59% still believe that they will be able to find the home of their dreams. However, this dream may look different depending on your specific circumstances. This guide will provide the resources you need to potentially lower your costs of living and secure affordable, desirable housing.

Read MoreProperty Tax Funding Blog

Property Tax Lenders: An Overview & Frequently Asked Questions

Posted on Mon, Nov 16, 2020 @ 17:11 PM

In Texas, there has been a lot of discussion about property tax loans. With the economy still lagging, many Texans are faced with property tax bills that they are struggling to pay. In this environment, many property owners are investigating whether property tax loans are good or bad. At first glance, those who owe real estate taxes and have insufficient resources may be hesitant to exchange one form of indebtedness with another. However, if you spend the time to investigate the benefits of a property tax loan, you’ll likely reach the same conclusion as countless others – Property Tax Loans Are Good!

Read MoreTexas Property Tax Loans: Huge Penalties in Texas for Failure to Pay Property Taxes

Posted on Sun, Nov 01, 2020 @ 15:11 PM

Property ownership in Texas comes with an obligation to pay annual Ad Valorem taxes. Every January 1st, local governments place liens on the properties in their jurisdiction, and these liens remain until the assessed taxes are paid. A failure to pay property taxes can be extremely costly, and it can also have other serious consequences.

Read MoreIn Texas, if a property owner does not pay their property taxes, the Tax Collector has a big hammer at his disposal to enforce the payment. In addition to large penalties and fees, the enforcement procedure begins with filing a suit against the property owner, followed by a court order to sell the property at a foreclosure auction, after which the proceeds from the foreclosure sale satisfy the outstanding property taxes.

Read MoreHow Lien Transfers Protect Homeowners

Each year Texas property owners are faced with their annual property tax assessment. For many Texans’ this bill can come at bad time, normally arriving around the holidays when already a tight budget can be strained. Many consider borrowing money to pay this bill, but in a sea of lending options it is important to make the right choice.

Read MoreProtection through Flexibility: Lien Transfers for the Public Good

Posted on Thu, May 11, 2017 @ 14:05 PM

In the state of Texas, a lien is created on every piece of property on January 1, with the purpose of collecting property taxes for the various taxing jurisdictions that apply to that property. A property tax bill is technically due upon reciept, and becomes delinquent in February following the year from when it was levied. After February 1st, interest and fees begin to accrue on the balance and do so every month until the bill is paid.

Read MoreProperty Tax Lending vs Tax Lien Transfers: What’s the Difference?

Posted on Mon, May 01, 2017 @ 14:05 PM

Despite being known for low taxes, Texas has the 2nd highest property tax rate in the country according to a recent study. This state has an almost unique system for levying and collecting those taxes. Because of these unique circumstances, a consumer product has been created to help homeowners satisfy this tax burden without going into default or suffering penalties.

Read MoreNo one likes paying taxes, but property taxes can be a real sore subject. On one hand, property taxes are essential to a city because they fund things like public education, transportation, and emergency help from police and firefighters -- all undoubtedly important to a city and it’s people. On the other hand, property taxes are based on the needs of a county.

In a recession, those budget needs can go up even though the economy is going down. Making up for those financial losses often means a hike in property taxes, even when property values have dropped. It can be heavy reading, but if you’re just getting to know property taxes, or you want to better understand them, this will give you a head start.

Taxes get a bad wrap. And understandably! Property taxes are no exception. However, as much as we’d like to keep that money, our property taxes play an important part in the development and maintenance of our city. Emergency services, parks, libraries, and city transportation are all possible thanks to property taxes. They also provide funding for public schools so that they can offer children free education. Like ‘em or not, property taxes come with benefits.

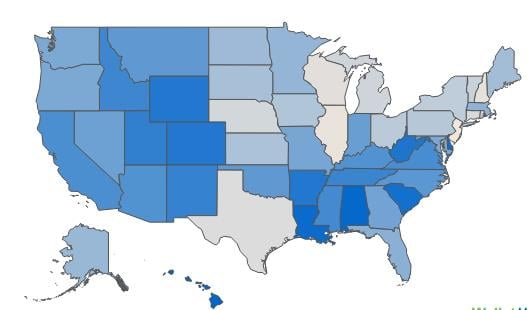

Read MoreOn the whole, property tax rates have been increasing over time. The snapshot below shows the states with the highest property tax rates as opposed to those with lower ones. Ever wondered where your state stands? The bluer the state, the lower the tax rate and conversely gray signifies a higher rate.

Read More