Custom Financing Solutions for Commercial Properties

Our commercial account team will take a consultative approach to understand your unique situation so we can craft a financing solution that meets your needs. Large dollar transactions require special expertise, which can make all the difference in determining the most efficient deployment of capital and return on investment.

We have the financial capability to pay your property tax bill, no matter how large. Our lending rates are extremely competitive, and we can structure a loan to fit your budget and anticipated cash flow.

Since 2008, Property Tax Funding has been helping Texas commercial property owners with affordable property tax payment plans, and we can help you too.

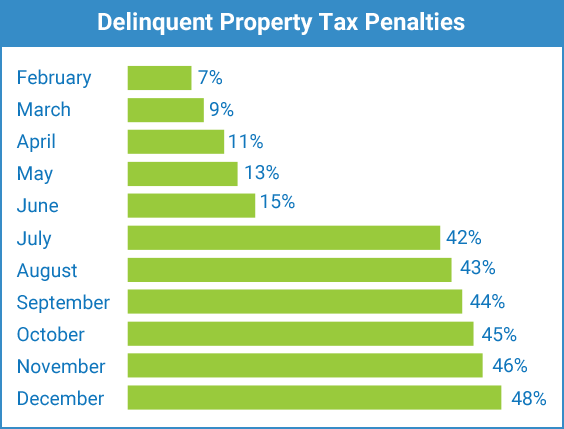

Commercial property owners in Texas pay some of the highest property taxes in the country. Worse yet, penalties and interest on unpaid property taxes can add an extra 48% to your tax bill in the 1st year alone. Don’t let your property tax bill cripple your cash flow and limit your future business opportunities. Consider the flexibility gained by financing your property taxes with a low-cost property tax loan from Property Tax Funding

Property Tax Funding helps thousands of property owners pay their taxes every year. We offer repayment plans specifically tailored for commercial property owners throughout Texas, and we provide loans for virtually every type of commercial property. We will pay your property taxes and structure an affordable repayment plan that not only meets your budget but allows you to maximize your cash flow and financial flexibility, allowing you to reinvest in your business.

1

The process is easy and takes just a few minutes. Once we have your basic information, we will send you the loan disclosures.

2

We review your completed application, perform a title search to confirm property ownership, verify the tax amount due, and prepare the final closing documents.

3

After your loan is approved, we will schedule a convenient time for closing. We can send our closing agent to you to sign the final documents.

4

Once we receive the signed documents, Property Tax Funding will pay your property taxes and send you a paid receipt from your taxing authority.

Property taxes that remain unpaid after February 1st are assessed a 7% penalty and interest fee by the tax assessor. The penalties and interest keep increasing every month until the past due property taxes are paid. As illustrated in the graph, an unpaid tax bill increases by up to 48% in the first year alone. Avoid the outrageous costs of delinquent taxes with a tax loan from Property Tax Funding.

Call Us Toll Free: 1-877-776-7391

Direct Phone: 214-550-3754

Fax: 214-296-9704

Email: loans@propertytaxfunding.com

Address:

Property Tax Funding

4100 Alpha Rd, Suite 670

Dallas, TX 75244