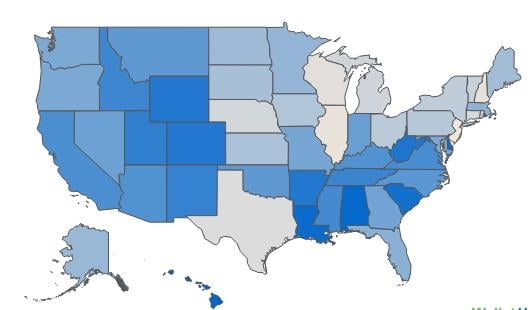

On the whole, property tax rates have been increasing over time. The snapshot below shows the states with the highest property tax rates as opposed to those with lower ones. Ever wondered where your state stands? The bluer the state, the lower the tax rate and conversely gray signifies a higher rate.

As is stands today, New Jersey is the state with the highest property tax rate as compared to every other state in the US. This Northeastern state is thought to be the No.1 worst state for property tax by Wallet Hub, with an effective rate of 2.29%. That means, you pay approximately $4,029 annually towards property tax based on the national median home value of $176,000. In reality, most New Jerseyans pay a lot more, as the state median home value in New Jersey is a whopping $319,900, bringing the average annual property tax up to $7,335. Illinois is in next place with the second highest property tax rates at 2.25%. Even so, Illinois’ real estate tax bill is still 46% lower than New Jersey! New Hampshire comes third, and with soaring home values, you are sure to pay over $4,000 in real estate tax. Note that these three states are the only ones to have crossed the 2% rate barrier. See where your state ranks in terms of property tax rates through this informative table below with states arranged in ascending order of their property tax rates:

|

Rank |

State |

Property Tax Rate |

Annual Taxes on $176K Home |

|

1 |

Hawaii |

0.28% |

$489 |

|

2 |

Alabama |

0.43% |

$764 |

|

3 |

Louisiana |

0.48% |

$841 |

|

4 |

Delaware |

0.53% |

$929 |

|

5 |

District of Columbia |

0.57% |

$1,005 |

|

5 |

South Carolina |

0.57% |

$1,009 |

|

7 |

West Virginia |

0.59% |

$1,035 |

|

8 |

Arkansas |

0.62% |

$1,088 |

|

8 |

Colorado |

0.62% |

$1,097 |

|

8 |

Wyoming |

0.62% |

$1,094 |

|

11 |

Utah |

0.69% |

$1,210 |

|

12 |

New Mexico |

0.72% |

$1,273 |

|

13 |

Tennessee |

0.75% |

$1,314 |

|

14 |

Idaho |

0.77% |

$1,354 |

|

15 |

Mississippi |

0.78% |

$1,377 |

|

16 |

Virginia |

0.80% |

$1,401 |

|

17 |

California |

0.81% |

$1,429 |

|

18 |

Kentucky |

0.84% |

$1,471 |

|

18 |

Arizona |

0.84% |

$1,484 |

|

20 |

North Carolina |

0.85% |

$1,502 |

|

21 |

Oklahoma |

0.87% |

$1,525 |

|

21 |

Montana |

0.87% |

$1,528 |

|

23 |

Indiana |

0.88% |

$1,539 |

|

24 |

Nevada |

0.92% |

$1,618 |

|

25 |

Georgia |

0.96% |

$1,682 |

|

26 |

Missouri |

1.00% |

$1,763 |

|

27 |

Oregon |

1.08% |

$1,890 |

|

27 |

Washington |

1.08% |

$1,903 |

|

27 |

Maryland |

1.08% |

$1,906 |

|

30 |

Florida |

1.10% |

$1,932 |

|

31 |

Massachusetts |

1.18% |

$2,075 |

|

32 |

Minnesota |

1.19% |

$2,091 |

|

33 |

Alaska |

1.21% |

$2,124 |

|

34 |

North Dakota |

1.22% |

$2,146 |

|

35 |

Maine |

1.27% |

$2,233 |

|

36 |

South Dakota |

1.36% |

$2,382 |

|

37 |

Kansas |

1.41% |

$2,478 |

|

38 |

Iowa |

1.47% |

$2,582 |

|

39 |

Pennsylvania |

1.51% |

$2,647 |

|

40 |

Ohio |

1.55% |

$2,729 |

|

41 |

New York |

1.58% |

$2,773 |

|

42 |

Rhode Island |

1.61% |

$2,829 |

|

43 |

Vermont |

1.72% |

$3,021 |

|

44 |

Michigan |

1.83% |

$3,220 |

|

45 |

Nebraska |

1.88% |

$3,301 |

|

46 |

Connecticut |

1.91% |

$3,357 |

|

47 |

Texas |

1.93% |

$3,392 |

|

48 |

Wisconsin |

1.97% |

$3,459 |

|

49 |

New Hampshire |

2.10% |

$3,698 |

|

50 |

Illinois |

2.25% |

$3,959 |

|

51 |

New Jersey |

2.29% |

$4,029 |

It’s also worth noting that the annual taxes are calculated on the national median home value of $176,000. In a lot of states the state median home value is a lot more or somewhat less. This means that you could actually end up paying more or less in taxes depending on your home value. For example, a home in Hawaii is averagely valued at $504,500 as opposed to a home in Delaware at $232,900. So even though Hawaii’s tax rate is lower than that of Delaware’s by 0.25%, someone if Hawaii would probably end up paying more if comparing taxes when based on homes priced at the state median value. If you’re struggling to pay your property tax, then consider a property tax loan to ease the burden.

Data aggregated from WalletHub.