Texas Property Owner's Tax Bills Continue to Increase

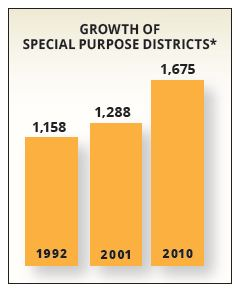

Property owners in Texas are facing higher property taxes again in 2013, thanks to higher property values and the continued increase in tax collecting entities such as special purpose districts. According to the Texas Comptroller of Public Accounts, more than 500 new special purpose districts have been created since 1992, which accounts for 87% of the growth in local entities that levy property tax. The revenue generated by these special purpose taxes are often assessed to pay for infrastructure or to fund services in unincorporated or developing areas. The most common special purpose districts are municipal utilities districts, emergency services districts and hospital districts. Coupled with recovering real estate values and rising home prices that will certainly raise property value assessments, Texas property taxes are likely to continue the rising trend in the years to come.

Failure to Pay Your Taxes Has Dire Consequences

These tax increases have many Texas property owners struggling to pay the bill, and failure to pay on time only compounds the problem. For property tax bills that remain unpaid by February 1 of each year, the tax collector will add a 7% penalty and interest in the first month, with an additional 2% penalty and interest accruing in each subsequent month. In July, if Texas property taxes remain unpaid, the cumulative penalty and interest jumps up to 18%. Worse yet, the taxing authority can add up to 20% for attorney fees and can file a lawsuit at any time, adding the related court costs to the bill as well, and ultimately resulting in a tax lien and a foreclosure sale of the property at auction. In just the first year of delinquency, penalties and interest can add up to 48% to the total tax amount owed.

A Property Tax Loan Can Help

Fortunately, there is a better option. If a homeowner is unable to pay his Texas property taxes in full on the due date, a property tax loan can be a good solution. A tax loan allows the homeowner to stretch the property tax bill across an extended payment term of up to ten years that suits his needs and budget, allowing for lower monthly payments at an interest rate that can save as much as 60% versus the penalties and interest charged by the tax assessor if the taxes go unpaid. Most importantly, a tax loan can save the property from foreclosure sale, making it a valuable resource for property owners feeling the pain of the continued increase in Texas property taxes.