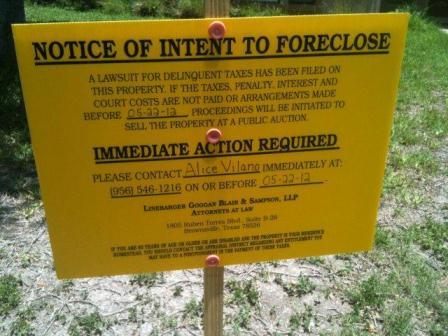

A property tax assessor-collector secures an interest in your property through a tax lien to ensure payment of taxes. If your property taxes remain unpaid, the tax assessor-collector has the legal right to pursue a property tax foreclosure of the lien and sell your home. The process normally begins with the filing of a tax suit by the attorney representing the tax assessor. If the taxes are not paid the tax suit will lead to a judgment foreclosing the tax lien and authorizing the sheriff to seize the property and sell it at public auction. Below you’ll see a picture of a sign placed in the yard of a property owner with a recent tax suit. It’s not only embarrassing to drive home to this in your front yard but also alarming to realize you are one step closer to losing your property. The following are 4 options for stopping the foreclosure:

Option 1 – Establish Repayment Plan with Tax Assessor

Some tax collectors allow property owners to set up payment plans, which allow payment of delinquent taxes in installments. A tax collector is not required to offer this option, but when they do the repayment timeframes are typically short. When offered, payment plans can be a good solution for property owners who plan to pay their taxes off in a year or less. However, if the county has initiated property tax foreclosure proceedings, this option may no longer be available. You’ll need to check with the tax assessor or their attorney to determine if payment plans are available.

Option 2 – Apply for a Tax Deferral

If you or your spouse is over 65 and you claim the property as your homestead, you are in luck. By applying for an over 65 tax deferral, the property tax foreclosure process will be stopped immediately. The property tax deferral program is also available for certain disabled property owners. See our blog covering this tax deferral program.

Option 3 – Secure a Loan for Taxes

While there are many different sources to borrow money for your property taxes, a property tax loan is considered one of the quick and easiest. Property tax loans normally take just a few days, even less if a foreclosure is looming. The tax loan will pay off all past due taxes, court costs, and legal fees. Better yet, Property Tax Funding offers loans with zero down closings and low rates. The experts at Property Tax Funding will save your home from foreclosure by paying your taxes and setting up a tax loan with low monthly payments and no prepayment penalty.

Option 4 – File for Bankruptcy

While this might be your last choice, a bankruptcy filing can be a viable option. The first thing a bankruptcy filing accomplishes is to stop the property tax foreclosure process. The filing of a bankruptcy petition invokes the automatic stay prescribed by the bankruptcy code and no collection or enforcement efforts can continue from the time of filing until the automatic stay is lifted or discharge or dismissal of the bankruptcy proceedings. The bankruptcy will not extinguish the tax debt, but it will give you time to reorganize your finances, sell the property, or find a financing source. While this will give you some breathing room, a bankruptcy can drop your credit score by as much as 250 points and can remain on credit reports for 10 years. Additionally, interest on the unpaid taxes will continue to accrue during the bankruptcy proceedings.

If your property is sold at auction, it will sell at a significant discount of market value. After your tax debt is paid, you’ll receive any excess funds, less the fees charged by the county and their attorney for handing the property tax foreclosure. What equity you have, could easily be wiped out. If your property is scheduled for foreclosure, you owe it to yourself take one of the actions listed above.