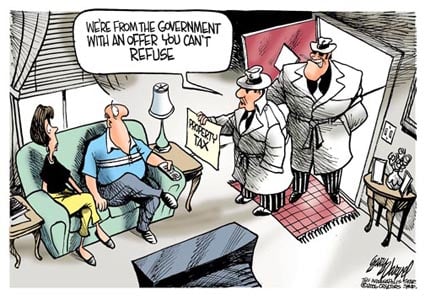

Property taxes can be a real monkey on your back. Once a year you have got to pay your property taxes and that burden can be a real blow to any headway you may have been making otherwise during the year. Even when you are cognizant of the fact that your property taxes are coming due, individuals don’t always have the funds available to pay their property tax bill. However there are a number of strategies for how to budget for your property taxes. Here's four ideas.

-

Auto-Save – One of the great things about modern banking is that so much of it is automatic. If you have a bank account where you can do this, trying some kind of an auto-save strategy is a great plan. Figure your estimated annual tax bill; then divide that amount by the number of times you are paid annually (52 if paid weekly or 26 if paid bi-weekly) and every time you get paid funnel that amount into a separate savings account. This account is for your property taxes only. Once you get the bill you can just access this account, write a check, and you’re none the worse for wear.

-

Manually Save – Another strategy for how to budget for your property taxes is to have a lock box or safety deposit box in your home. This is especially good if you handle a lot of cash during the day. Just stashing away a predetermined amount every day you work or every week at weeks end can really help you save without even noticing it.

-

Examine Your Budget – If neither of these other rather straightforward tactics are going to work for your property tax savings agenda you have got to go another way. Begin first by figuring out and examining your budget. Look for small consistencies which can be eliminated. Maybe you spend $7 a day on espresso based coffee or maybe you go out to lunch every day and that’s going to wind up costing you a lot of money. You need to have an honest look at your budget and then make smart choices you can live with. If the difference is between your paying your taxes or going out to some foo-foo coffee place and having a latte every day, there really shouldn’t be any questions about that.

-

Cancel a Service – While this last option is never something that we want to have to do, if you really are having a hard time finding places to cut from your budget, this may be the only end left. If it’s the high-speed wireless service you may just have to forego home Internet. If you have the exclusive cable packages then maybe you have go to cut back to basic cable. If your “Time,” “Newsweek,” and “GQ” magazine subscriptions are costing you too much, you may just have to do without. This is something of a last resort but if your expenses and spending are outweighing your income you’re just going to have to do without something.

Of course if you really don’t know how to budget for your property taxes and you feel as though you’re teetering on the edge towards some far more dramatic end, there’s really no need to see any of that come to fruition. Instead you can reach out to property tax loan specialists like Property Tax Funding. Taking out a property tax loan can help you get over the hump in your life and find some relief from the stress of past due property taxes.