We Pay Texas Property Taxes

Whether it’s due to unforeseen expenses, loss of income, unexpected medical expenses, or a general economic downturn, many Texas property owners struggle to pay their property taxes.

Property Tax Funding has helped over 12,000 residential and commercial property owners in Texas avoid costly interest, fees, and penalties charged by the tax assessor on past-due property taxes. We will pay your delinquent property taxes, penalties, and interest and provide you with a customized repayment plan that fits your budget. Our loans allow you to stop the mounting fees and penalties charged by the tax assessor while taking advantage of our low rates and flexible payment plans.

What Happens If You Don't Pay Your Property Taxes in Texas?

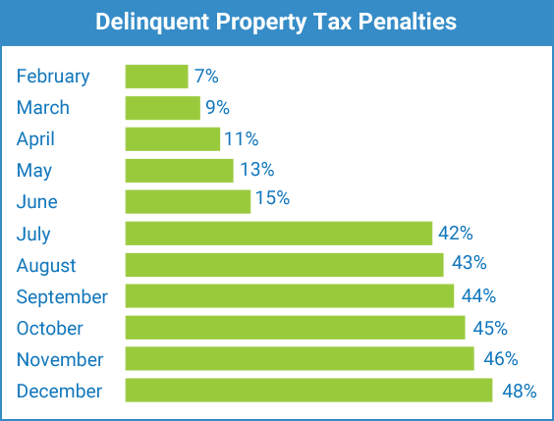

When your property taxes become delinquent on February 1, the tax assessor places a tax lien on your property. Then, the taxing authority will charge interest and penalties with each passing month until paid.