Property ownership in Texas comes with an obligation to pay annual Ad Valorem taxes. Every January 1st, local governments place liens on the properties in their jurisdiction, and these liens remain until the assessed taxes are paid. A failure to pay property taxes can be extremely costly, and it can also have other serious consequences.

Failure to Pay Property Taxes Results in Stiff Penalties and Interest

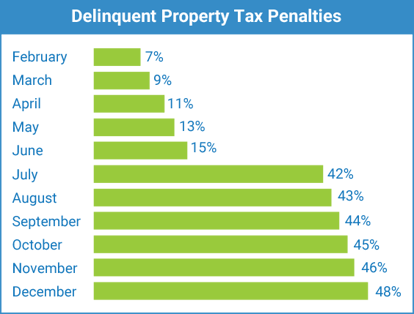

The deadline for paying property taxes in Texas is January 31st. Property owners who don't pay on time face rapidly accumulating penalties and interest. In February alone, a failure to pay property taxes results in a six-percent penalty and a one-percent interest charge. By July 1st, the cumulative interest, penalties, and attorney fees total 42 percent, and interest continues to accrue until the entire balance is paid.

The deadline for paying property taxes in Texas is January 31st. Property owners who don't pay on time face rapidly accumulating penalties and interest. In February alone, a failure to pay property taxes results in a six-percent penalty and a one-percent interest charge. By July 1st, the cumulative interest, penalties, and attorney fees total 42 percent, and interest continues to accrue until the entire balance is paid.

When the Collection Attorneys Get Involved

A failure to pay property taxes by July 1st also substantially increases the amount that owners have to pay to settle their tax bill. On that date, local tax assessors across the state send delinquent property tax accounts to their attorneys, who tack on their steep collection fees. These fees are typically 20 percent of an outstanding balance, on top of the taxes, interest, and penalties already piling up. Collection fees raise the potential first-year delinquency charges to a whopping 48 percent.

Failure to Pay Property Taxes Has Long-Term Repercussions

Ultimately, a failure to pay property taxes on a residential, commercial, or rental property will result in a lawsuit. The suit will add court costs and legal fees to an already escalating balance and put an owner at serious risk of foreclosure and property loss at auction. If there's a mortgage on a property, tax delinquency can also leave the owner vulnerable to a drastic jump in their monthly payments if their mortgage company steps in to pay off their tax bill before they do.

Texas Law Provides a Stress-Relieving Solution to an Unpaid Property Tax Problem

Property owners have an alternative to the nightmare of delinquency thanks to a Texas state law that allows a third-party lender to assume their property tax lien and pay off all the overdue taxes, interest, penalties, and legal fees. A low-interest property tax loan with no upfront out of pocket costs and flexible repayment terms can stop the tax assessor's collection process in its tracks.

Past Due Property Taxes – Huge Penalties in Texas for Late Payment

It has been often said that there are two certainties in life, death and taxes. While we hope these certainties are mutually exclusive, property taxes may be the exception. With a sure arrival of a tax bill sometime in October or November and with penalties, interest, and attorney costs that can scare a property owner to death, the annual planning for and paying for property taxes can be an unwelcome event. While there are circumstances that may prevent you from paying your property taxes, the longer you allow your past-due property taxes to go unpaid, the more expensive and risky it becomes for you.

What Happens When Property Taxes are Past Due?

Penalty and interest charges increase your bill.

Penalty charges and interest charges will be added to your tax balance. Private attorneys hired by taxing units to collect delinquent accounts can charge an additional penalty to cover their fees. The following table details the potential penalties, interest, and attorney charges imposed on a past due property tax account.

Accounts not paid in full by June 30th of the year they become past due are normally referred to a delinquent tax attorney for collection and incur an additional penalty equal to 15% - 20% of the total taxes, penalties, and interest.

-

Delinquent tax notices will start arriving.

-

You may have the option to set up an installment plan.

-

You may be sued!

-

You could lose your property!

What other options are available to pay property taxes?

Specialized lenders exist who focus solely on property tax lending. These lenders provide an alternative to the lump sum payment of your property taxes. A property tax loan will immediately stop the added penalties, interest, attorney fees, and pending lawsuits for the county. Most lenders offer flexible loan terms with extended payment schedules. Loans are available for almost any type of real estate as long as the borrower is not in bankruptcy and the property is reasonably maintained. This includes residential, commercial, investment properties, and vacant land. Qualifications are easy, and credit score is typically not a factor.

A property tax loan may not be right for everyone, especially property owners with taxes due less than $2,000. Additionally, borrowers with excellent credit may find lower interest rates through their local bank or credit union. There may be other capital sources available, so it's important to investigate all your options.

While you might want to put off addressing your past-due property taxes, the most expensive decision is to do nothing. With first-year penalties of up to 48%, my advice is to address your past-due property taxes sooner rather than later.

You can start the easy application process for a Texas property tax loan online. If you'd prefer to speak with a friendly, licensed Property Tax Funding loan officer, call us at 877-776-7391.