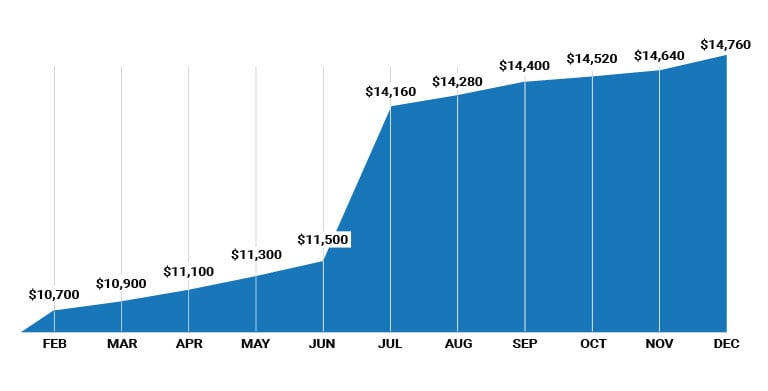

Property taxes that remain unpaid after February 1st are assessed a 7% penalty and interest fee by the tax assessor. The penalties and interest keep increasing every month until the past due property taxes are paid. As illustrated in the graph, an unpaid $10,000 tax bill can grow into a $14,760 liability by December of the same year. With penalties of up to 48% in the first year, there is tremendous incentive to get your taxes paid.